Diploma in Cooperatives and Credit Union Management

Program Duration: 12 Weeks

Delivery Mode: 100% Online (Live Classes, Case Studies, Assignments & Workshops)

Final Capstone Project: A problem-solving research project identifying a critical issue in

microfinance or credit union management.

10 Modules

List of Services

-

Module 1: Introduction to Cooperatives & Credit UnionsList Item 1

- History, principles, and structure of cooperatives

- The role of credit unions in financial inclusion

- Legal and regulatory framework for cooperatives in Cameroon

- Differences between credit unions and commercial banks

-

Module 2: Governance & Leadership in Credit UnionsList Item 2

- Structure of governance in cooperatives and credit unions

- Roles and responsibilities of board members, executives, and staff Ethical leadership and good governance practices

- Conflict resolution and decision-making in cooperatives

-

Module 3: Financial Management & Accounting for Credit UnionsList Item 3

- Basic accounting principles for cooperatives

- Financial statements and reporting standards

- Budgeting and financial planning

- Common financial mismanagement issues and how to prevent them

-

Module 4: Risk Management & Internal ControlsList Item 4

- Understanding financial risks in microfinance and credit unions

- Fraud prevention and detection

- Implementing internal controls and compliance measures

- Credit risk assessment and loan management

-

Module 5: Credit Union Law, Policies & Regulatory Compliance

- Overview of microfinance and cooperative laws in Cameroon

- Regulatory bodies governing credit unions

- Compliance with anti-money laundering (AML) regulations

- Consumer protection and legal frameworks

-

Module 6: Loan Delinquency – Causes and Strategies to Curb It (NEW)

- Understanding loan delinquency and its impact on credit unions

- Key causes of delinquency: Poor assessment, economic downturns, member

- defaults

- Strategies to reduce loan delinquency: Proper credit evaluation, risk-based pricing, and monitoring

- Loan recovery techniques and legal recourse options

-

Module 7: Lending, Savings & Investment Strategies

- Loan origination and credit analysis

- Designing savings products that attract members

- Managing delinquency and loan recovery strategies

- Investment strategies for credit unions

-

Module 8: Marketing, Member Engagement & Customer Service

- Building a strong membership base

- Effective marketing strategies for cooperatives

- Enhancing customer service and member retention

- Digital transformation and fintech opportunities

-

Module 9: Strategic Management & Growth Planning for Credit Unions

- Developing a long-term strategy for cooperatives

- Scaling operations while maintaining financial sustainability

- Managing change and innovation

- Strategic planning and leadership development

-

Module 10: Capstone Project – Identifying & Solving a Critical Issue in the Microfinance or Credit Union Sector

3 Possible Capstone Project Assignments:

- Loan Delinquency Management & Default Reduction Strategies:

- Governance & Leadership Failure in Credit Unions:

- Regulatory Compliance & Fraud Prevention in Microfinance Institutions:

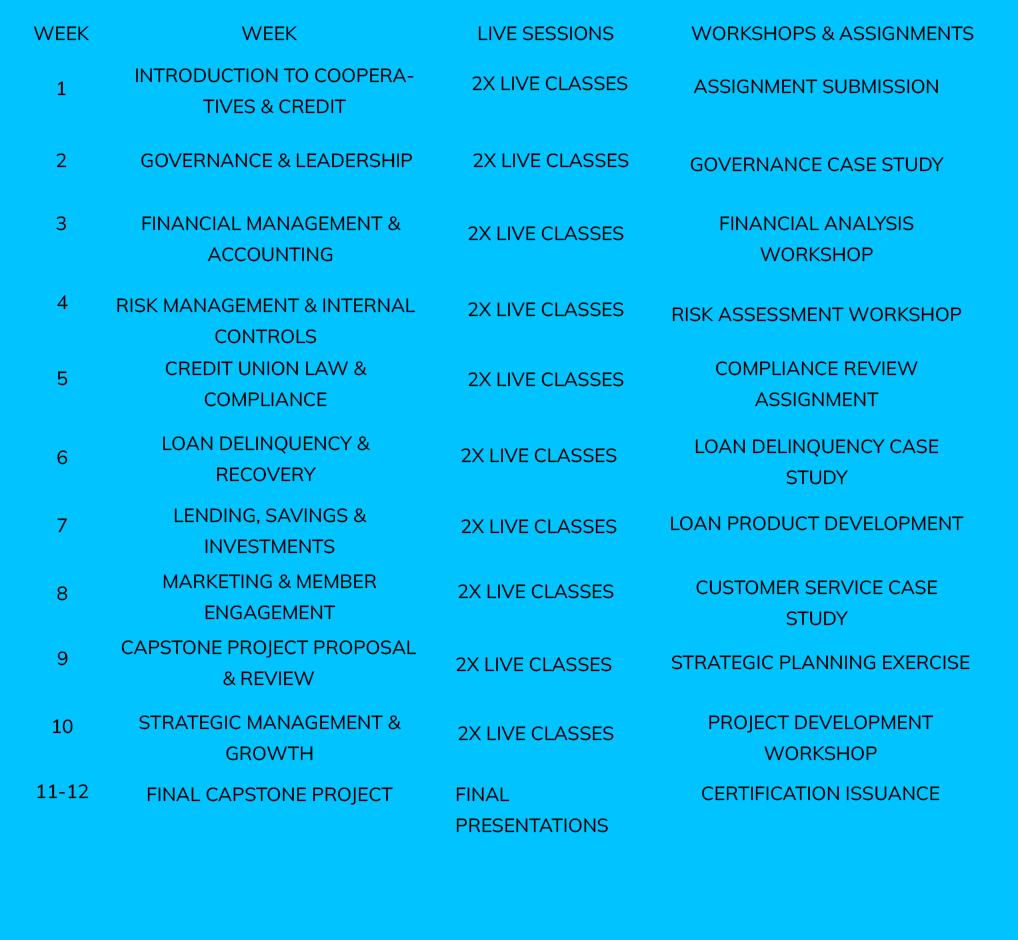

Delivery Method & Program Schedule (Cohort-Based Learning: 12 Weeks)

Key Enhancements in the Revised Version:

✅ NEW Module on Loan Delinquency & Recovery Strategies – Dedicated module to

address loan defaults, a key issue in the sector.

✅ Workshops on Loan Delinquency & Financial Risk Management – Hands-on case study

sessions.

✅ Loan Delinquency as a Capstone Project Option – Participants can analyze real-world

data and propose solutions.

✅ Strategic Approach – Modules structured to progress from foundational knowledge to

problem-solving applications.